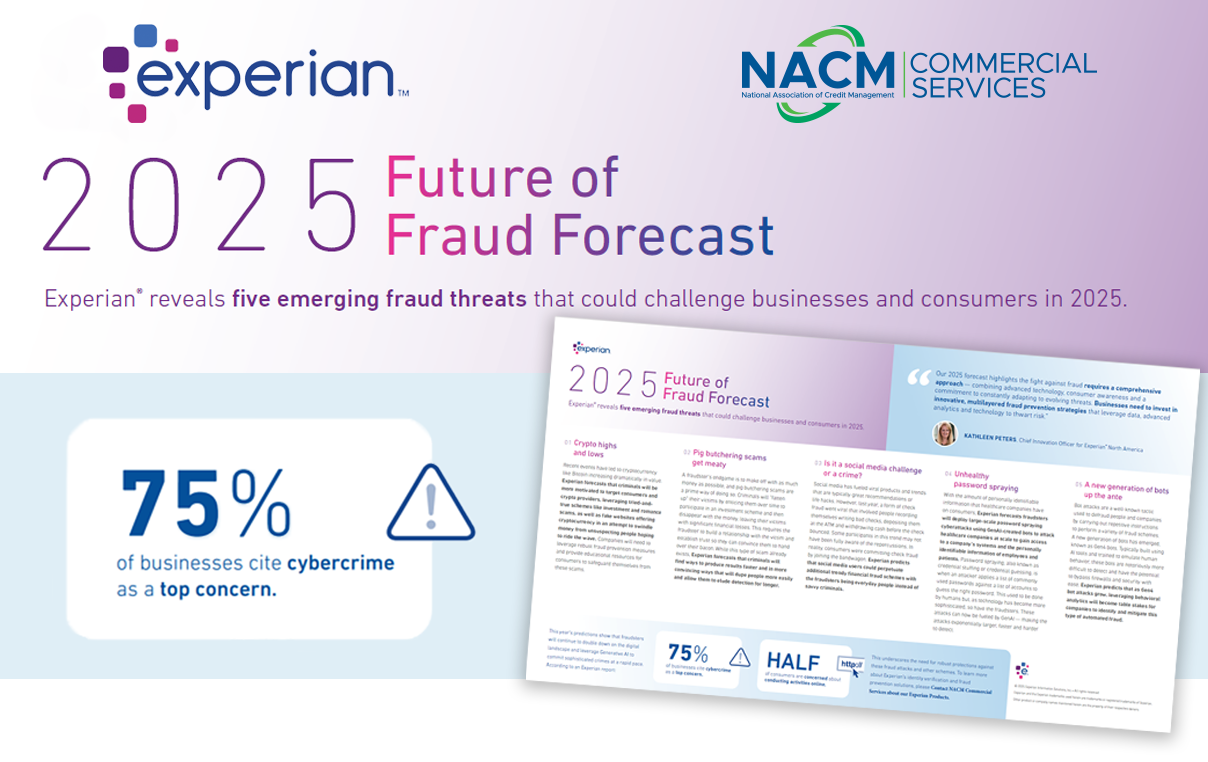

Five Emerging Fraud Threats

01 Crypto highs and lows

02 Pig butchering scams get meaty

03 Is it a social media challenge or a crime?

04 Unhealthy password spraying

05 A new generation of bots up the ante

Download the infographic for more details and insights on Fraud.

Experian’s Commercial First-Party Fraud Score

Fraud is rising for small businesses and small business lenders. And the different forms of fraud are not created equal. If you are lending to small businesses, you may have customers today that are not really who they say they are, because their business identity information was misused by a criminal enterprise, OR you may have customers with bad intent that have no intention of paying you back.

Fortunately, Experian has analytics to help lenders avoid this scenario and more…you can use these tools to fight back and address different types of fraud. Whether it’s first payment defaults, commonly known as credit abuse, OR synthetic forms of fraud from social engineering schemes like mule accounts, account takeover, AND even multi-account collusion between businesses.

With Experian Commercial Fraud Solutions, it’s never been easier to differentiate fraud risk within your commercial lines of business. With solutions powered by new data attributes and algorithms that are easy to use, through a single partnership that taps into extensive fraud networks. Connect with Experian today to learn how you can solve all the forms of fraud within your commercial lines of business.

Have questions? We’ve got answers—reach out today!

customerservice@nacmcs.org or 800.622.6985