NACM National Trade Credit Report

The NACM National Trade Credit Report (NTCR) is comprised of trade experience reported by more than 10,000 members, which represents a database of millions of current trade lines of payment history on businesses nationwide.

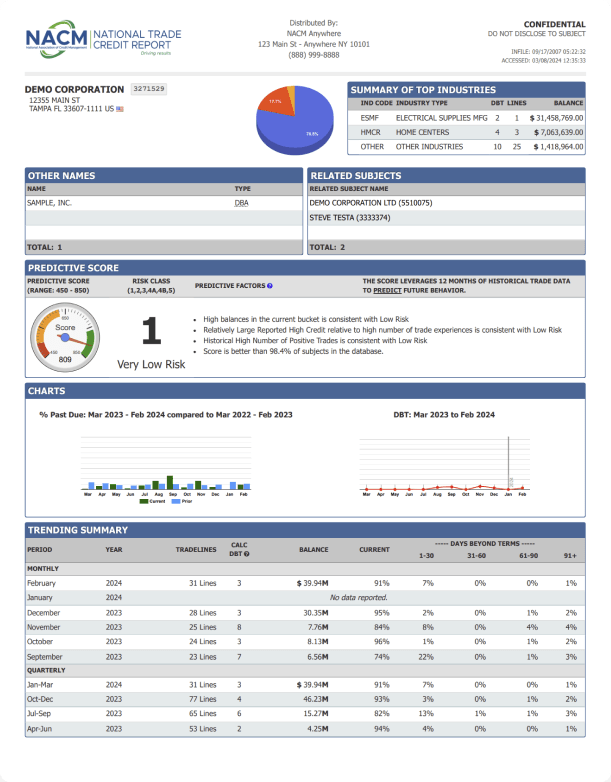

Insights Provided by the NTCR

The NTCR provides a detailed listing of individual company experiences, organized by contributing NACM Affiliates. This includes a summary of creditor interactions with the subject, Monthly and Quarterly Trends, a predictive delinquency score, and a risk class based on more than 40 factors, with the most significant ones highlighted.

Comprehensive Trade Experience Data

- A list of current trade experiences along with a summary of the top industries reporting.

Predictive Risk Score

- Predicts the payment and severe delinquency looking forward 6 months.

Valuable Trend Summaries

- Compares past due trend analysis by month/quarter displaying the days beyond terms with the total dollars owed along with the number of creditors reporting.

Public Record Data

- Public record information includes judgments, state and federal tax liens, bankruptcy listings and more.

Risk Management Tools

NACM’s Portfolio Risk Analysis (PRA) & Account Monitoring System (AMS) platform is free to members who contribute their data.

These tools are for NACM members only and are supported nationally across the NACM affiliates by our members and trade groups, updated with new and refreshed data daily to help you be on the pulse of change within your portfolio of customers.

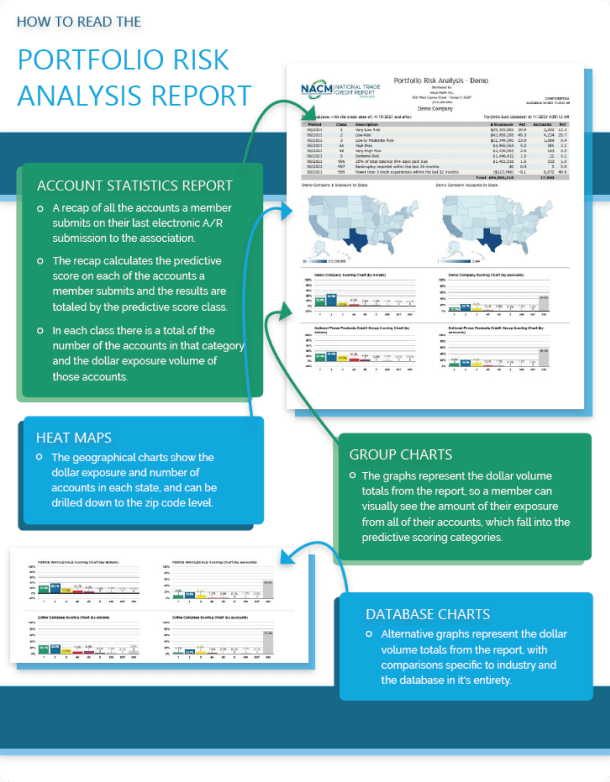

Portfolio Risk Analysis

Export to Excel or Create PDF

- Refresh at any time to update score categorization and exposure.

Interactive Heatmaps

- Use the Interactive Heatmaps to visualize your company’s accounts receivable data exposure nationwide. State-by-state, the heatmaps will show the dollar exposure and the number of accounts. Use your mouse to roll over the states to view the state-by-state summary of your data, or click on the state to see the detailed accounts.

Compare your Portfolio Performance

- Compare your Portfolio Performance to your Industry Groups, your Industry, and the overall NACM National Trade Credit Report participants.

Data Points by State

- The data table shows detailed information about your accounts, including the dollar exposure and number of tradelines on the National Trade Credit Report (NTCR).

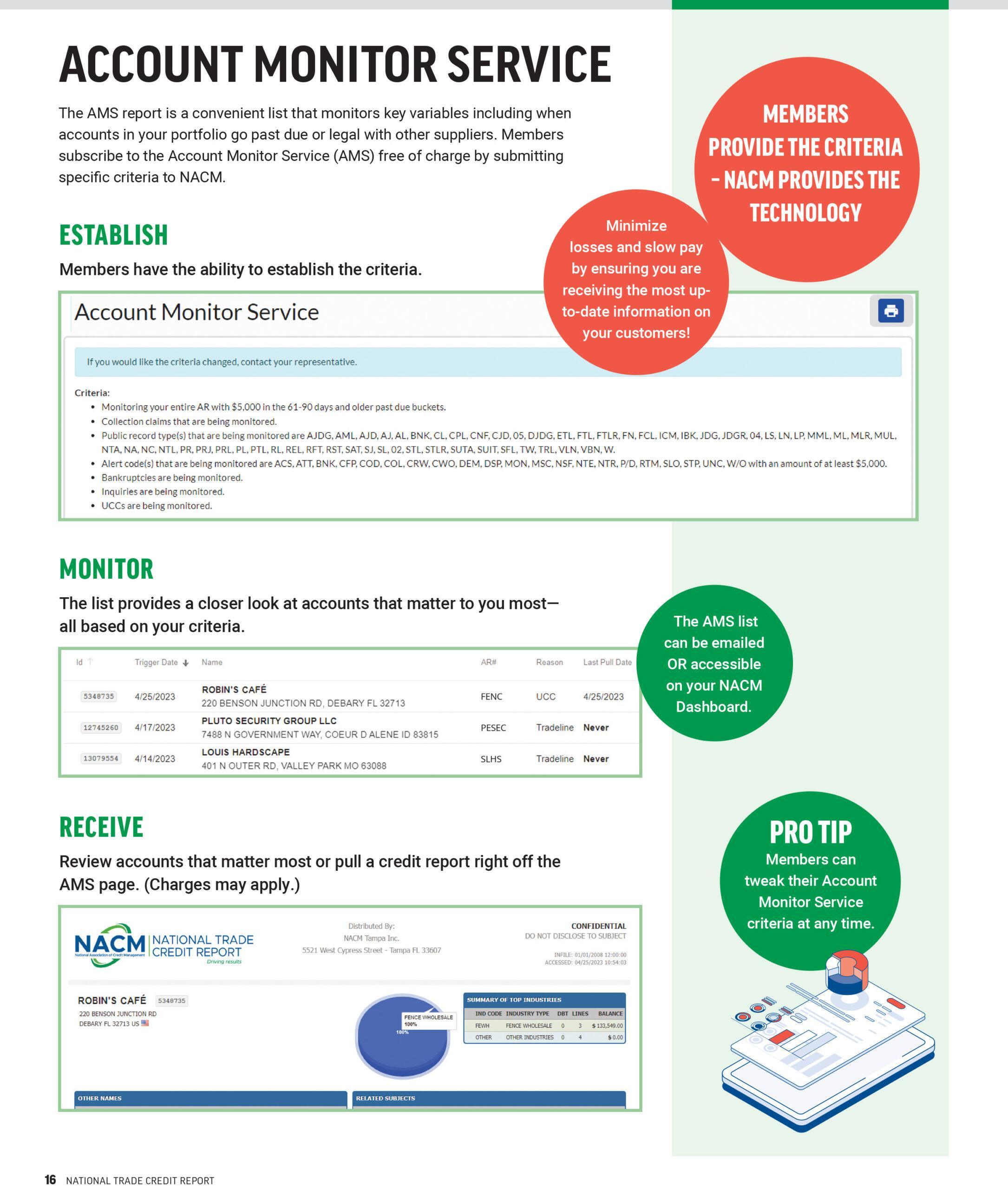

Account Monitoring Service

Set Your Criteria

- The Account Monitoring System allows you to set the criteria that you want to be notified about; aging buckets, public records, collections, etc.

Submit Specific Criteria

- Members can subscribe to the Account Monitor Service (AMS) by submitting specific criteria to NACM Commercial Services.

Get Notified

- Members can receive email notifications and log into the NTCR website to view their custom list.

faq

NACM Credit Reporting

Are Commercial Credit Reports instant?

Yes, after you are set up you will have online access to instant reports.

I can’t find the company I am looking for. What should I do?

Yes, we offer several international report options, both real-time reports and freshly investigated.

Why an NTCR over another report?

The major reporting agencies offer several of the same components of a credit report. One key benefit of the NTCR report is identifying member numbers displayed first for the local affiliates. This allows industry group members to identify their peers within the report between meetings.

How can a business credit report help my company?

A business credit report can help your company make informed decisions by providing insights into the financial health and payment behavior of potential clients, partners, and suppliers. This can aid in risk management, credit decisions, and establishing strong business relationships.

What information is included in a National Trade Credit Report (NTCR)?

The NTCR consists of trade information including trend analysis, chart of top industries reporting, a predictive score, collection accounts. You may also request additional information such as public records which includes judgments, state and federal tax liens and more.

faq

General Credit Reporting

Are Commercial Credit Reports instant?

Yes, after you are set up you will have online access to instant reports.

Can I get business credit reports on international companies?

Yes, we offer several international report options, both real-time reports and freshly investigated.

I can’t find the company I am looking for. What should I do?

Try searching with fewer details. Use just the company’s name and state to improve your chances of finding it. If you’re still unable to locate the company, please note that businesses are not required to provide their data. Contributing data is crucial for creating comprehensive reports.

How can a business credit report help my company?

A business credit report can help your company make informed decisions by providing insights into the financial health and payment behavior of potential clients, partners, and suppliers. This can aid in risk management, credit decisions, and establishing strong business relationships.

What information is included in a business credit report?

A business credit report typically includes the company’s credit history, payment patterns, public records (such as liens, judgments, and bankruptcies), company background information, financial statements, and credit score. Reports vary depending on the vendor and type of report.

Credit Reporting

A Word From Our Members

KEEN, Inc.

BakeMark USA LLC

Walters Wholesale Electric