Manage Your Entire Credit Management Process with Experian Business IQ

Access unrivaled data, analytics and technology to drive operational excellence, better decisions and the best business outcomes.

Operational Excellence & Better Decisions

Our services help our clients improve the consistency and quality of their business decisions in areas including credit risk, fraud prevention, identity management, customer service and engagement, account processing, and account management.

Data

Data is at the heart of what we do – with data quality and accuracy at the forefront. We continue to explore ways to harness our data and to power opportunities.

Analytics

Design smarter strategies with analytics. We distill data into actionable insights and business intelligence to help you optimize your every decision and realize your vision.

Technology

Accelerate innovation with cutting-edge technology. We leverage the most advanced tech stack and to deliver our data and analytics efficiently, securely and at scale

Business IQ Premier Profile

Designed to quickly highlight the information contributing to a company’s overall risk potential. The report’s unique risk dashboard highlights key performance metrics and potential high-risk alerts

Business Owner Profile

Small businesses make up 99 percent of US companies. Business Owner Profile combines consumer & commercial data to provide the most accurate, current and comprehensive data to help avoid the high risk associated with small businesses.

Commercial First Party Fraud Score

The Commercial First Party Fraud Score is a Business Information Services (BIS) product that predicts the likelihood that a loan application involving a commercial entity will result in a costly early lifecycle default.

Credit Application Processing

Process applications quickly & efficiently which keeps costs down. Add in automated decisioning to free your staff to focus on more critical task.

Portfolio Scoring

Statistical risk scores are applied to each account in a customer portfolio enabling them to make quick, easy credit decisions.

Decision IQ

Web-based decisioning and application processing software designed to automate B2B credit approvals. Drive predictive risk insights with speed and precision for help with your automation and digital transformation needs.

RISK MANAGEMENT

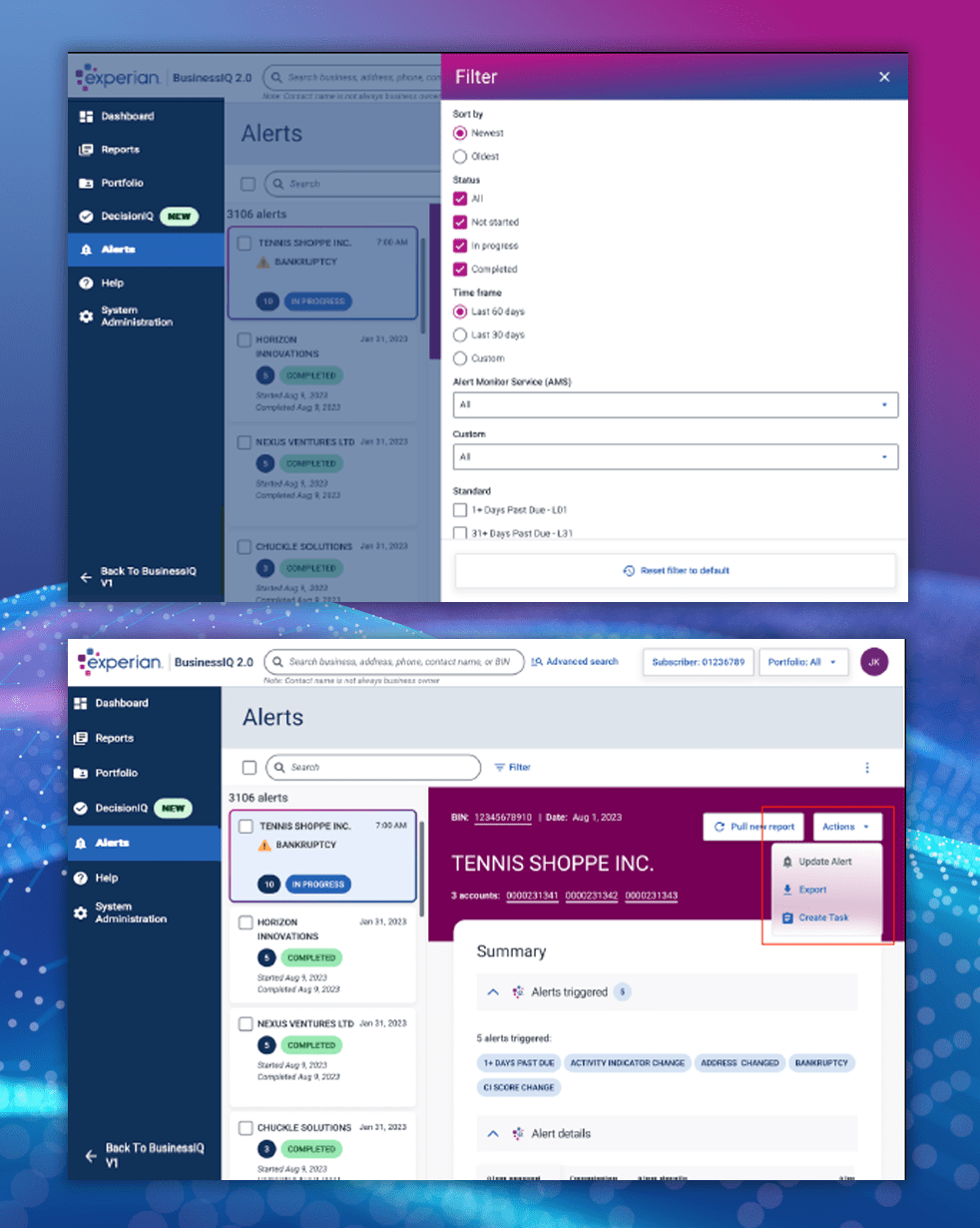

Experian Account Monitoring Service

Do you have clear visibility into your customers’ credit status?

The Experian Account Monitoring Service offers real-time alerts and comprehensive online commercial credit management applications to help businesses manage their credit portfolios effectively.

Receive notifications on up to 99 different Triggers

Access unrivaled data, analytics and technology to drive operational excellence, better decisions and the best business outcomes

Late Payments (30, 60, 90 day delinquency)

Track overdue payments and identify potential credit risks with detailed delinquency monitoring.

Bankruptcy Alerts

Receive timely notifications about bankruptcy filings to manage credit exposure effectively.

Lien, Judgment, & Collection Filings

Stay informed about legal actions and collection activities that may impact creditworthiness.

Score Change Alerts

Get real-time updates on changes to credit scores to adjust risk management strategies promptly.

Total Balance Changes

Monitor fluctuations in total balances to detect significant financial movements.

Credit Utilization Changes

Track changes in credit utilization to assess financial health and creditworthiness.

Small Business Credit Share Consortium

Access consortium-based alerts to manage risks within small business portfolios efficiently.

faq

Experian Credit Reporting

How do I obtain access for Experian credit reports?

Contact customer service for the completion of the appropriate documentation. You will generally have access within a couple days.

Do I need approval to access a business credit report?

No approval is necessary for a business credit report. Unlike personal credit reports which are regulated under permissible purposes only, commercial business credit reports can be ordered as often as you wish.

Are credit reports instantaneous?

Yes. You are provided the website logins and after entering the search information, it will deliver back the report instantly.

What if I cannot find the report I am looking for?

If you have already searched once, please contact customer service for assistance to avoid duplicate billings. Generally, it is better to search with less details such as company name, city and state.

What information is generally on a business credit report?

A business credit report typically includes the company’s business facts, credit history, payment patterns, public records (such as liens, judgments, UCC’s, and bankruptcy listings), credit scores, and more.

What does the Experian’s Credit Risk Score indicate?

The score is from 1 to 100. One indicates high risk; 100 indicates low risk. There are two exclusion scores. A 998 displays when there is a bankruptcy within the past two years. A 999 displays when there is not enough information to score the business.

What does Experian’s Financial Stability Risk Score indicate?

The Financial Stability Risk Score predicts the likelihood of financial stability risk within the next 12 months.

Can I obtain a consumer report from Experian?

Yes, Experian offers the Business Owner Profile report. These reports are for accessing the owner’s personal credit information when you have obtained a personal guarantee, or they are a small business lacking information on their business credit report. You must have a written authorization for accessing these reports and should be aware of all FCRA guidelines.

faq

General Credit Reporting

Are Commercial Credit Reports instant?

Yes, after you are set up you will have online access to instant reports.

Can I get business credit reports on international companies?

Yes, we offer several international report options, both real-time reports and freshly investigated.

I can’t find the company I am looking for. What should I do?

Try searching with fewer details. Use just the company’s name and state to improve your chances of finding it. If you’re still unable to locate the company, please note that businesses are not required to provide their data. Contributing data is crucial for creating comprehensive reports.

How can a business credit report help my company?

A business credit report can help your company make informed decisions by providing insights into the financial health and payment behavior of potential clients, partners, and suppliers. This can aid in risk management, credit decisions, and establishing strong business relationships.

What information is included in a business credit report?

A business credit report typically includes the company’s credit history, payment patterns, public records (such as liens, judgments, and bankruptcies), company background information, financial statements, and credit score. Reports vary depending on the vendor and type of report.

Experian Services & Credit Reporting

A Word From Our Members

Carson Oil

Tillamook County Creamery Association

Stoneway Electric Supply Co.

American Int'l Forest Prod LLC

Conmas Construction Supply