Collection Agency Services

When it comes to recovering your outstanding receivables, you need a partner that not only understands the intricacies of collections but also values the relationship you have with your customers.

Why use NACM Commercial Services As My Collection Agency?

At NACM Commercial Services, we don’t just collect; we connect. We take the time to understand both your company and your debtors because knowing the full picture helps us find effective ways to get you paid.

Our approach is tailored to your unique needs, ensuring that the collection process is not only effective but also aligns with your company’s values and goals.

Join the multitude of satisfied clients who have experienced the NACM difference.

Collection Inquiries

Ready to recover what's yours? Contact us today to explore how we can support your collection needs!

Submit a Claim

Our collection process ensures efficient claim handling, offering assertive, transparent, and streamlined procedures for quick resolution.

Collections Payment

Our secure payment platform ensures convenience, reliability, and seamless transactions for all your financial needs.

Collection FAQ

To recover receivables, you need a partner who understands collections and values your relationships with customers.

Features & Benefits

Proven Expertise

No collector with less than

20 years of agency experience.

Not a “revolving door” of trainees.

Trusted Consultation

Advisor-style guidance and interaction with our professional collector team who have experience in all industries.

Boutique Style Attention

You aren’t just a number lost in the crowd. You are important. Every account is critical and we can flex to adjust our style to fit the needs.

Flexible Tools

Customizable and special projects tailored to your needs.

24/7 Online Portal Access

Place accounts, review account status and review our collector notes.

Advanced Investigation

We implement the use of today’s AI tools for skip tracing and other investigative purposes to enhance probability of success

Risk-Free Structure

No money collected, no fee charged.

No financial cost or risk to you.

Local, National & Global

Is your customer halfway down the street or halfway around the world? Our reach extends locally, nationally and globally.

Attorneys & Litigation

We have creditor-rights attorneys across the U.S. and internationally, offering services from demand letters to litigation and judgment enforcement.

10 Day Free Demand Service

Use our reputation to secure payment within 10 days with no fees; after that, the account moves to "Immediate Action."

Immediate Action

Once your account is placed, we promptly begin demanding full payment with added leverage.

Trust Account, Bonded, Insured

Trust our reputable firm to protect your interests and reputation with trust accounting, full insurance, and bonding.

NACM CS is Certified with Commercial Collections Agencies of America (CCAofA)

You will have an increased level of confidence knowing NACM Commercial Services maintains an active annual compliance certification through the CCAofA and is among select elite agencies who hold high standards for collection performance and remittance processes. Our expert collectors with years of experience maintain active senior collector certifications. Your claims will be handled among the best in the third-party collection industry!

Join our Credit Community

Meet Greg Garner,Vice President – Collection Operations. His vast knowledge in various industries makes him an asset in swift debt recovery.

Questions about collection services? Call Greg today!

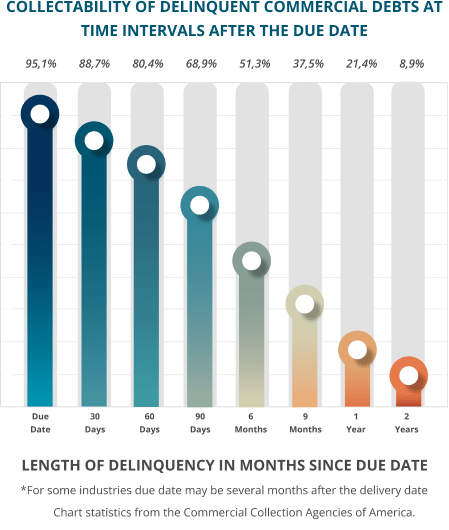

What Happens to an Account When You Wait to Submit a Claim?

Delaying the submission of a claim can have significant repercussions for your account. Not only might you miss crucial deadlines, but you could also face potential complications in the claim process that affect the outcome. It’s essential to understand the potential risks and impacts of waiting, ensuring you act promptly to safeguard your interests.

faq

Collection Services

How can I place an account for collection?

Established clients may use our website as the quickest and easiest way to submit a claim. If you prefer, you may complete a claim placement form and submit it along with your supporting documentation by email or mail.

Can I place an account for collection even if I don’t have a credit application from our customer?

Yes, you may. Please provide copies of your invoice and/or statement along with any other documentation you may have to support your claim and submit it with a claim form.

Does NACM handle foreign collection accounts?

Yes, NACM collects internationally.

Why should I use a collection agency?

Every company wants more time to focus on its good-paying customers. A collection agency can help you with the delinquent ones. We make every attempt to deal with your customer so that, in addition to collecting the past-due balance, you and your customer may feel comfortable continuing your sales relationship.

If my customer has filed bankruptcy, can I place the account for collection?

At this point, there is nothing NACM can do to assist in the collection of the monies due. Creditor should file their Proof of Claim with the Bankruptcy Court.

Can NACM attach business assets or file a lien on real property?

Yes, but only where NACM has managed the lawsuit process and a court judgment has been obtained.

When should I turn an account over for collection?

Studies have shown that debtors are more likely to pay once a third party gets involved. After three months, the probability of collecting a delinquent account drops to 69.6%; after 6 months, 52.1%; and after one year, 22.8%. It’s in your company’s best interest to send your accounts to collections sooner rather than later.

My account is over a year old. Is it too old to collect?

No, the statute of limitations ranges from 3 to 10 years, depending on the debtor’s state of residence. Please send supporting documentation for review.

If I utilize a 10 Day Free Demand and the customer has surfaced to offer a partial payment or a payment plan, may I cancel the 10 Day Free Demand?

No. The 10 Day Free Demand instructs your customer to Pay In Full within 10 calendar days. Anything short of payment in full will roll over into full collection service by NACM on the 11th day.

Are the officers of a Corporation or an LLC personally liable for the debts of those entities?

No. Unless you have also obtained a signed Personal Guaranty.

Once I have placed an account with NACM for collections services, should I continue to communicate with the customer in an effort to collect the outstanding balance?

No, not without first communicating with the NACM Collection Agent assigned to your matter. Once an account has been placed with NACM, the Fair Debt Collection Practices Act requires that a single party communicate with debtors to avoid claims of harassment.

faq

General Questions

How does membership in NACM work?

The NACM membership is a company benefit and multiple credit people in a department can benefit from the services and trainings. Once you become a member of NACMCS, we also register you as a national member where you receive additional benefits.

Can I get assistance with strengthening our credit application?

Absolutely! NACMCS reviews your credit application and makes suggestions to strengthen the document to best protect your company while extending credit to clients.

How do I get help finding an industry group for a specific industry?

On a national level NACM has over 350 different industry groups. If you’re looking for coverage in a specific geographic area or industry, we can help you find the perfect match for your company.

How do I network with other credit professionals?

NACMCS is the perfect place to meet new credit professionals, virtually and in-person. There are endless opportunities to interact with others, learn from peer networking, and gain confidence the credit practices in your business are top notch. Conferences, forums, virtual discussion groups, trainings, and online communities are available to members.

What is AR Data Contribution?

A majority of NACM member companies choose to report their client’s payment patterns to NACM and credit bureaus monthly to assist building client’s business credit scores or reflecting slow paying customers. Contributing the information gives companies leverage in debt collection. NACM offers this service free with a membership, as it believes the reporting assists the overall credit community. It’s how commercial credit reports are built. Various complimentary services are offered to member companies who contribute their AR aging to the NACM database and other reporting agencies as an added benefit. Members can request to remain anonymous while practicing good policy of contributing payment data.

What’s available to companies who are non-members?

NACM is a trade association built to support our community of credit professionals. Most benefits are offered to member companies. There is a limited number of services offered to companies who cannot become members, but the fees are much higher. The magic happens behind the Member Portal!

Collection Services

A Word From Our Members

Urban Outfitters